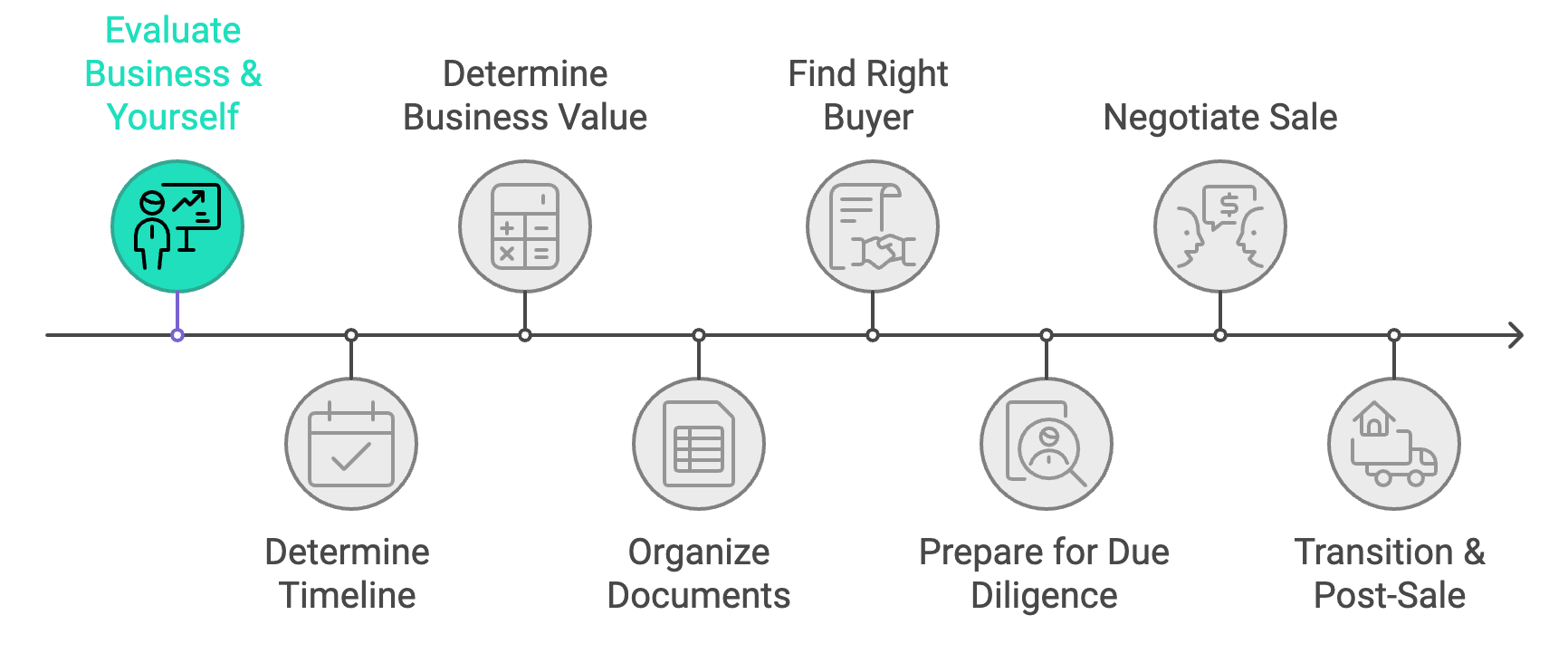

General Steps of Selling Your Business

Considering the sale of your business leads to a multitude of questions. How do I find a buyer? How do I value my business? Is now the best time to sell? These are great questions and require careful consideration before making any decisions. This article will explore the various steps and considerations involved in preparing to sell your business.

Step 1: Evaluate Your Business and Yourself

Before even considering putting your business on the market, it is essential to evaluate its current state. This includes analyzing financial records, operational processes, and customer satisfaction. Take a critical look at your business and identify any areas that may need improvement. This will not only make your business more attractive to potential buyers but also ensure you get the best possible price for it.

Now that you have evaluated your business, take a moment to really consider if you are ready to sell. What's next in your life plan after the sale? Will you retire? Will you travel? Will the proceeds from the sale be enough? These are all important questions to ask yourself because once the business is sold, that's it; you've committed to the next stage in your life.

A few things to consider:

Are you willing to stay on as an employee after the sale?

How much training will the new ownership need, or are you willing to provide?

If there is real estate, do you want to be a landlord or sell the property with the business? (A monthly rental income is nice, but it could come with potential headaches)

Stock Sale or Asset Sale?

How many "personal" items do you expense through the business? (We all do it!)

Key Piece of Advice: Evaluate your business and your future goals to make an educated decision if selling is right for you. We often see only emotional decisions determine the outcome, and I can assure you this is never the best approach.

Step 2: Determine Your Timeline

Selling a business is not a quick process, and it's important to have a realistic timeline in mind. Rushing the sale could result in a lower price while dragging it out for too long can lead to a loss of interest from potential buyers. Consider the current market trends and personal circumstances when setting your timeline. The lending process (through trading means like the SBA) can often take 90 or more days to complete. The biggest factors we see that affect the timeline are real estate appraisals, attorneys who are backlogged, and failure to secure all necessary documents for the lenders.

Key Piece of Advice: Start preparing your business for a sale 1-3 years before you plan on going to market.

Step 3: Determine the Value of Your Business

One of the biggest challenges in selling a business is determining its value. It's vital to have a realistic understanding of what your business is worth based on its assets, profits, and potential for growth. One of the most common methods used in business valuation is called the Market Method. This method can be compared to how your house is valued. The real estate agent looks at similar homes in your area and uses their listing price and sales history to determine the value of your home. With the Market Method for business valuations, we use advanced technology to review the transactional history of similar businesses either in your local market or on a larger scale. From this process, we gain what is called a "multiple," which is an average multiplier of EBITDA (earnings before interest, taxes, amortization, and depreciation) or SDE (seller discretion earnings, also known as "adjusted EBITDA") of your business. We use this in a formula to give a business value.

Many business owners fail to realize that there is a big difference between the Value of a business and its Sellability. This is a BIG topic, and we will cover it more in-depth in a separate article.

Key Piece of Advice: Be realistic about what your business is worth and understand the factors of value and sellability.

Step 4: Get Your Documents in Order

Having all the necessary documentation ready is crucial in the selling process. This includes financial records, tax returns, legal contracts, and any other relevant paperwork. Having these documents organized and readily available will not only make the process smoother but also increase the credibility of your business. Sure, most of the essential documents are obtained, but we often run into issues where the current owner does not have a login or password for essential items like the website, email account, social media, and other business software.

Most common documents needed:

3 - 5 Years Tax Returns

3 - 5 Years P&L statements (Including YTD)

3 Years Balance Sheets (Including YTD)

Copies of Key Contracts

Income Projection Sheet

Equipment List (often referred to as FF&E)

Business Valuation

The collected documents can be uploaded into a Virtual Data Room or "VDR." This allows us to easily grant secured access to key members of the transaction such as the buyer, lender, accountant, and attorneys. This allows for quick and easy access by all parties, which in turn makes the whole selling process much faster.

Key Piece of Advice: We often come across businesses with poor financial records, so if you are considering a sale in the near future, we highly recommend seeking professional accounting help.

Step 5: Find the Right Buyer

Finding the right buyer is crucial in ensuring a successful sale. You want someone who not only has the financial means to purchase your business but also shares your values and vision for its future. It's so important for a business broker to understand the owner's values and goals so we can determine if the potential buyer is the "right buyer" for you and your business.

As a brokerage firm, we often speak with hundreds, if not thousands, of people before finding the "right buyer." Sure, you can throw a business for sale up on BizBuySell or one of the other listing platforms, but in all honesty, most of those leads are looking to steal financial information or are curious competitors or private equity firms looking to persuade you into an unfavorable deal. That is why you need to seek other strategies to find the "right buyer" and have a vetting process for the leads.

Key Piece of Advice: Just because they are a "Buyer" does not mean they are the "Right Buyer."

Step 6: Prepare for Due Diligence

Once a potential buyer is interested, they will put together and sign a Letter of Intent (LOI) and conduct due diligence to thoroughly examine your business. This includes digging into financial records, processes, contracts, and any other relevant information. Be prepared to answer questions and provide documentation during this stage. A typical due diligence period is 60-90 days.

Most of the due diligence questions can be answered initially by putting together an excellent business overview and quality of earnings for your financial statements. When we build our business overview, our goal is to have it answer 90% of the common questions a potential buyer will have. This way, we save an enormous amount of time in due diligence (often 30-45 days) and build trust with the potential buyer.

Key Piece of Advice: Identify and answer the most common and expected questions before the due diligence period even starts. Also, make sure you can easily explain and prove all items on your P&L/Balance Sheets, including any adjustments done for the valuation.

Key Piece of Advice: We always make sure the LOI is non-binding and allows you to continue marketing the business for sale. This way, you are not stuck to one potential buyer.

Step 7: Negotiate the Sale

Negotiation is a crucial step in the selling process, and it's important to have a clear understanding of your bottom line. Be open to compromise but also stand firm on what you believe your business is worth. Business brokers should build a "term sheet," which, exactly as it sounds, lays out all the terms of the sale. The term sheet will be sent to both party's attorneys to not only save time (and money) but ensure accuracy.

As the buyer works through their due diligence, they will also be engaging an attorney to prepare a draft purchase agreement. This agreement will work as the legally binding contract for the sale of your business. We highly recommend working with a legal professional to ensure the accuracy and legality of the contract. Trust me; we have seen some very sneaky things added to the legal mumble jumble of purchase contracts.

Key Piece of Advice: Create a detailed term sheet that both buyer and seller sign. This will be key to making sure both attorneys understand the deal.

Step 8: The Transition & Post Sale

For some reason, everyone seems to forget to prepare for this step. It's essential to plan for life after selling your business. Consider your personal goals and future plans, and have a strategy in place for how to manage the proceeds from the sale.

Questions to ask yourself:

Will the funds be enough for me to retire?

Do I have a good financial advisor?

How will I tell my employees about the sale? (A good brokerage firm should help guide you through the transition)

How will my taxes be affected?

Will this sale affect my community or how they view me?

What's next?

Key Piece of Advice: Professionals are at your disposal, whether it be for tax advice, financial planning, or guidance on handling the transition from one owner to the next. Use their expertise to make sure your future is successful.

Selling a business can be a complex and emotional process, but by following these steps and seeking professional guidance, you can ensure a successful sale. Remember to take your time, evaluate all options, and be open to compromise. With proper preparation and careful consideration, you can achieve a profitable and satisfying outcome for both you and the future owner of your business.

In addition to the steps outlined above, there are other important considerations when preparing to sell your business. These include:

Market Conditions

It's crucial to have a good understanding of the current market conditions before putting your business up for sale. This can help you determine if it's the right time to sell and what potential buyers may be looking for. This can be based on your business's industry, your geographical location, or even based on interest rates.

Finances and Taxes

Selling a business involves complex financial transactions and tax implications, so it's important to have a thorough understanding of these before proceeding with the sale. Consider seeking advice from a financial advisor or accountant to ensure all financial aspects are properly addressed.

Confidentiality

Maintaining confidentiality is important during the selling process, as it can affect the reputation and value of your business. Consider having potential buyers sign a non-disclosure agreement before sharing sensitive information. Do not send your company's confidential information just because someone asks; there must be a vetting process for each lead. Also, any time you send private information, ensure it is secured through encrypted email or a virtual data room.

Employee Involvement

Involving your employees in the selling process can help ensure a smooth transition for both them and the new owner. Keep them informed and address any concerns they may have about job security or changes in company culture. Buyers are thrilled when key employees know about the sale because it means less risk. Key employees are also very useful when helping you prepare a business for sale.

Now that being said, we only see employees aware of the sale in about 20% of our cases. Sure, it may be beneficial if they do, but that does not mean it's always the best option. Don't feel bad or guilty if you decide it's best not to disclose the sale to them. Through years of dealmaking, we have many tips and tricks to make sure the employees feel positive about a transaction, whether it's pre or post-sale.

Preparing for the Unexpected

Selling a business can be a long and unpredictable process, so it's important to have a backup plan in case things don't go as expected. This could include having other potential buyers lined up or exploring alternative options, such as merging with another company.

We tell every client that something will come up. It could be through the due diligence process, a detail in the purchase agreement, a month before closing, or the day of closing, but there is always an unexpected bump in the road. We say this not to scare our clients but to assure them we know it's not always smooth sailing, and we are prepared to deal with any situation that may arise. Remember, every problem has a solution.